Do you want to build wealth from scratch but don’t know where to start? You’re in the right place! Welcome to Success Handshake, where we break down the smartest money moves to help you achieve financial freedom.

“Money doesn’t come to those who wait—it comes to those who take action.”

The journey to wealth isn’t a secret reserved for the rich—it’s a formula, and anyone can follow it. Whether you’re broke, in debt, or just starting out, stick with me because every step matters.

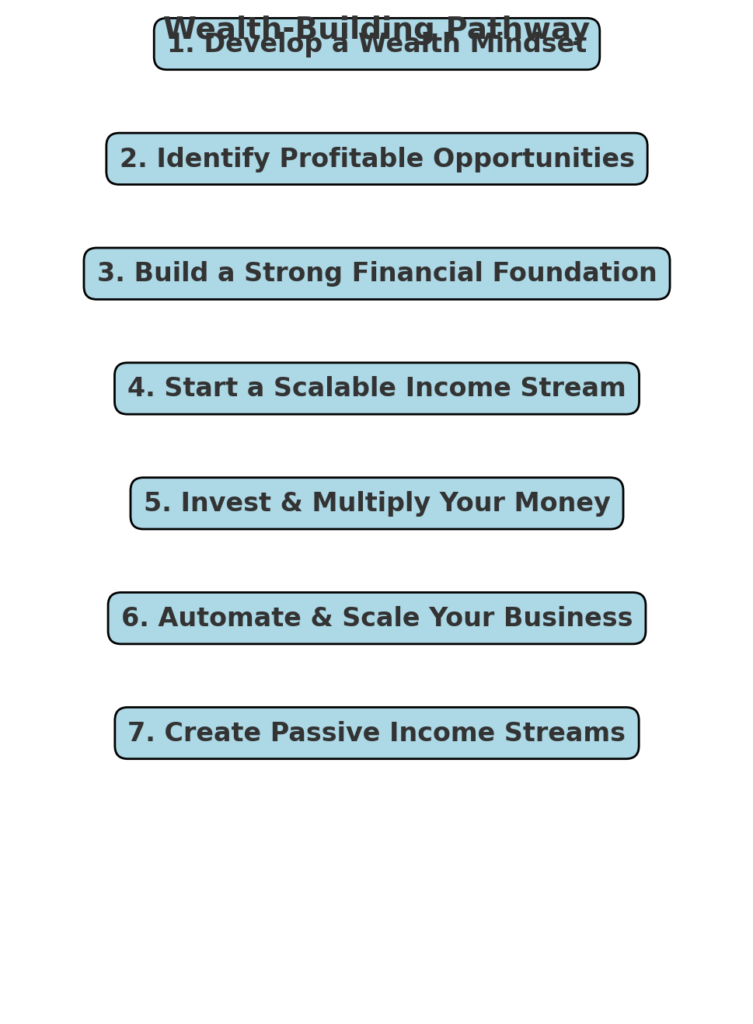

Building wealth isn’t about luck—it’s about mindset, strategy, and execution. By following the right steps, you can go from struggling financially to creating sustainable income streams that lead to long-term prosperity. This guide will help you develop a wealth mindset, identify profitable opportunities, manage money wisely, and build multiple income sources that grow over time. Are you ready to take control of your financial future? Let’s dive in!

Step 1: Develop a Wealth Mindset

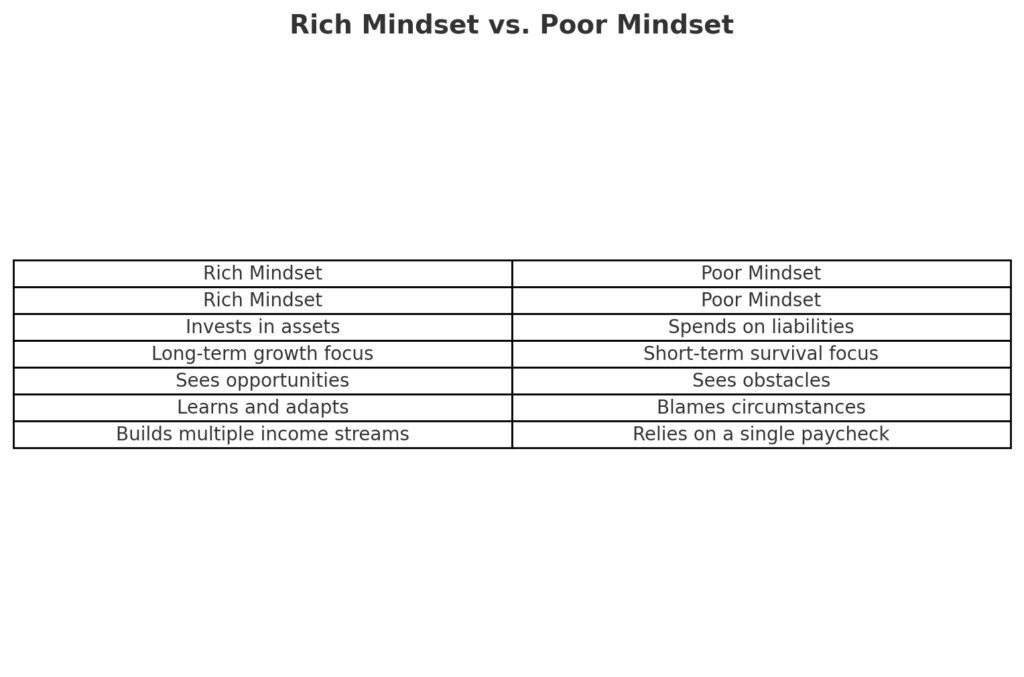

Everything starts in the mind. If you want to change your financial reality, you first have to change how you think about money. Your mindset determines how you earn, spend, and invest, making it the foundation of wealth-building.

The rich and successful don’t just work hard—they think differently. They prioritize assets, seek opportunities, and plan for long-term growth, while those who struggle financially tend to focus on expenses, liabilities, and short-term survival. The first step to financial success? Rewiring your mind for prosperity.

Think about this: If you handed a million dollars to someone with a poor mindset, they’d likely lose it within a few years. But if you stripped a wealthy person of everything they own, they’d find a way to rebuild their fortune. Why? Because wealth isn’t just about money—it’s about how you think, how you make decisions, and how you spot opportunities where others see obstacles.

How to Build a Rich Mindset

- Educate yourself by reading books like Rich Dad, Poor Dad, The Psychology of Money, and The Millionaire Fastlane.

- Follow successful people who have achieved what you aspire to. Learn from their experiences, habits, and strategies.

- Eliminate negative beliefs about money, such as “money is evil” or “rich people are greedy.” Instead, see money as a tool for growth and impact.

- Shift your focus from spending to growing money. Instead of asking, “Can I afford this?” ask, “How can I afford this?” This small shift changes how you approach earning and investing.

Actionable Tip:

Pick one financial book and commit to reading at least 10 pages a day. Small daily habits lead to a wealth-building mindset over time.

Step 2: Identify Profitable Opportunities

Now that your mindset is in the right place, it’s time to take action. The biggest mistake most people make? They say they want to make money but never actively explore real opportunities.

The truth is, money is everywhere—you just need to know where to look. In today’s digital economy, there are countless ways to build wealth, and many of them don’t require large capital to start. Here are some of the most profitable opportunities available today:

- Online Businesses – Dropshipping, Print-on-Demand, and Coaching.

- Freelancing – Video editing, Copywriting, Graphic design (Upwork, Fiverr).

- Investing – Stocks, Real estate, Crypto (long-term wealth growth).

- Digital Products – Online courses, E-books, and Subscription services.

How to Find the Right Opportunity for You

The mistake many people make is jumping into trends blindly without considering if the business model suits them. Instead, ask yourself:

- What skills do I already have? (Monetize what you know.)

- What am I willing to learn? (Develop high-income skills like digital marketing, AI tools, or programming.)

- What type of business fits my lifestyle? (If you prefer flexibility, freelancing or digital products might be ideal.)

For example:

- If you love writing, start freelancing on Upwork or Fiverr.

- If you enjoy teaching, create a digital course or an eBook.

- If you’re tech-savvy, explore AI tools, software automation, or affiliate marketing.

Actionable Tip:

Make a list of three potential income opportunities that align with your skills and interests. Pick one and start researching how to get started today. The sooner you take action, the sooner you start building wealth!

Step 3: Build a Strong Financial Foundation

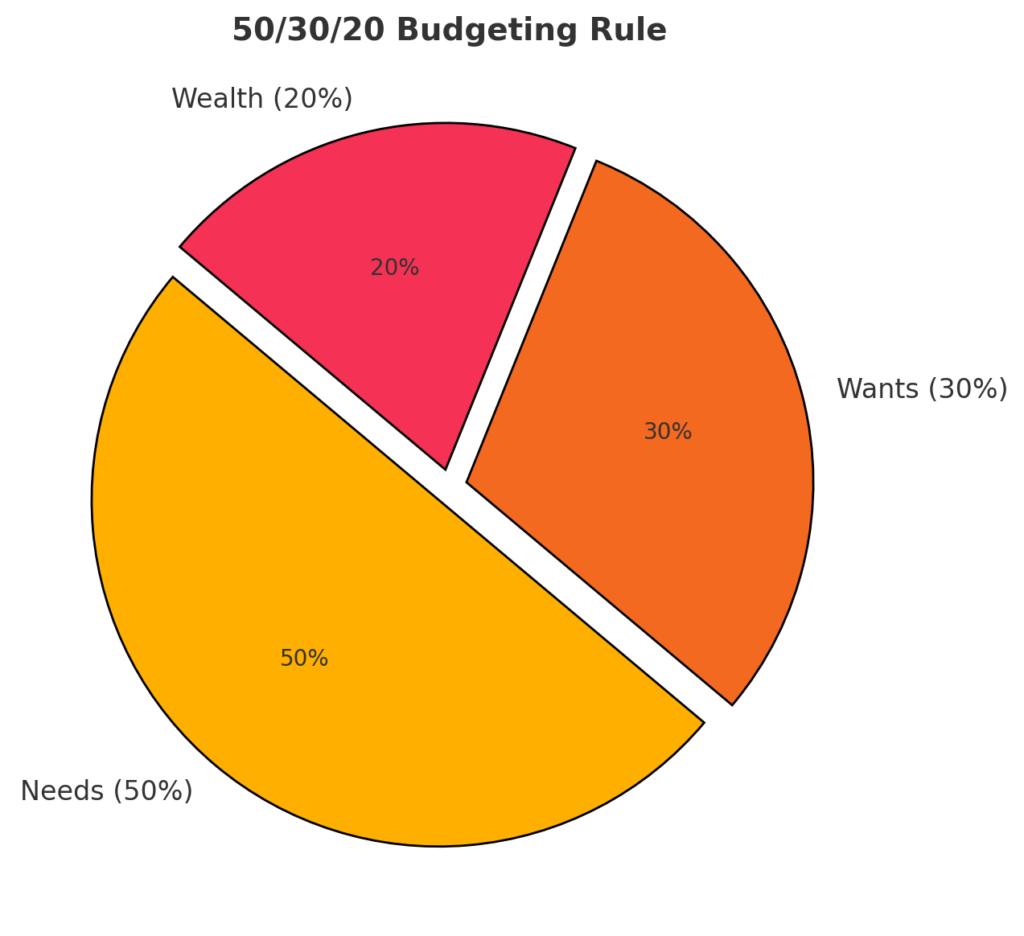

You can’t build wealth if you don’t know how to manage money. That’s why the third step is about building a strong financial foundation. If you earn $10,000 but spend $10,000, you’re still broke. The secret is to control your money before it controls you.

- 50% for Needs (Rent, food, bills)

- 30% for Wants (Entertainment, travel, hobbies)

- 20% for Wealth (Investing, saving, business growth)

Most people go wrong by spending first and trying to save what’s left. Flip the script: Save and invest first, then spend what remains.

Handling Debt

Debt is a wealth killer. Use either:

- The Snowball Method (Pay off the smallest debts first for momentum)

- The Avalanche Method (Pay off the highest interest debts first to save money)

Start Investing Early

Even if you start with $50 per month, investing in index funds, ETFs, or a high-yield savings account can make a difference.

Actionable Tip: Download a budgeting app like YNAB, Mint, or Personal Capital to start tracking your expenses today.

Step 4: Start a Scalable Income Stream

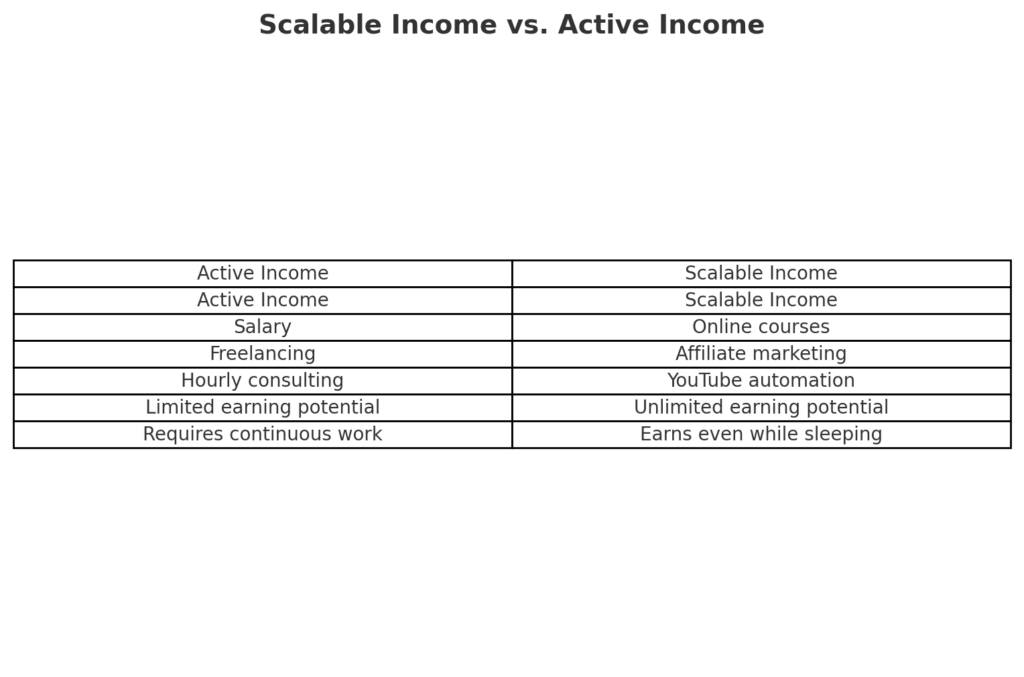

Most people rely on a 9-to-5 job, where they trade time for money. But here’s the problem—you only have 24 hours in a day. If you want to achieve financial freedom, you must break free from this time-for-money trap and build scalable income streams that grow without requiring constant effort.

A scalable income stream allows you to earn more without increasing your workload. Instead of working longer hours to make extra money, you set up systems that generate income even while you sleep. This is how wealthy individuals multiply their income without being limited by time.

Examples of Scalable Income Streams

- Selling Digital Products – Create and sell eBooks, online courses, or templates. Unlike physical products, digital products don’t require manufacturing or shipping, making them highly scalable.

- Blogging or YouTube Automation – Content works for you 24/7. A well-monetized blog or YouTube channel can generate passive income from ads, sponsorships, and affiliate marketing long after you’ve created the content.

- Dropshipping or Print-on-Demand – Sell products without handling inventory. With dropshipping, suppliers handle shipping, while you focus on marketing. Print-on-demand allows you to sell custom designs without upfront costs.

- Subscription-Based Businesses – Offer exclusive content or memberships where customers pay recurring fees. Examples include coaching communities, software-as-a-service (SaaS), and membership sites.

Why Scalable Income is Key to Wealth

Scalable income allows you to escape financial limitations and grow your earnings exponentially. Instead of relying on one paycheck, you build multiple income streams that require less maintenance over time. This is why entrepreneurs, investors, and online creators achieve wealth faster than traditional employees.

Actionable Tip:

Research high-income skills like copywriting, software development, consulting, or digital marketing. These skills can help you build a scalable online business that grows over time. The key is to start small, learn continuously, and scale up strategically.

Step 5: Invest & Multiply Your Money

Earning money is just Step One. But if you don’t learn how to multiply it, you’ll always be dependent on your paycheck. The key to building long-term wealth is making your money work for you through strategic investments.

Wealthy people don’t just save money; they grow it by investing in assets that appreciate over time. The goal is to generate passive income and increase your net worth without working harder. The earlier you start investing, the more you can benefit from compounding growth.

Smart Investment Strategies

- Stock Market – Investing in the stock market is one of the easiest ways to grow your money. Beginners should start with low-cost index funds like S&P 500 ETFs, which provide diversified exposure to top companies with minimal risk. Over time, the market has consistently grown, making it a reliable long-term investment.

- Real Estate – Rental properties can generate monthly passive income while increasing in value. Whether you buy and rent out property or invest in REITs (Real Estate Investment Trusts), real estate is a solid wealth-building strategy.

- Cryptocurrency – Digital assets like Bitcoin and Ethereum have proven to be high-risk, high-reward investments. While they can experience volatility, smart investors diversify and invest only what they can afford to lose.

- Businesses – Investing in your own business or buying shares in profitable businesses can lead to massive financial gains. Owning a business allows you to scale income beyond what a traditional job offers.

Why Investing is Crucial

Keeping money in a savings account won’t help you beat inflation. Over time, the value of cash decreases, but investments grow in value, helping you maintain and expand your wealth. The sooner you start investing, the more time your money has to grow.

Actionable Tip:

Start by investing as little as $50 per month in index funds. Even small investments can turn into significant wealth over time due to the power of compounding interest. The key is consistency and patience!

Step 6: Automate & Scale Your Business

If you’re doing everything yourself, you’re still limited by time. No matter how hard you work, there are only 24 hours in a day. This is why wealthy people focus on scaling their businesses by leveraging automation and outsourcing.

The key to making serious money isn’t just working harder—it’s working smarter by building systems that allow your business to grow without your constant involvement. When you automate, your business can operate 24/7, generating revenue even when you’re not actively working.

How to Automate Your Income

- Zapier – A powerful tool that connects different apps to automate repetitive tasks like sending emails, updating spreadsheets, and scheduling social media posts.

- ClickFunnels – A sales funnel automation platform that converts website visitors into customers without requiring you to handle each sale manually. This tool is ideal for businesses selling digital products, online courses, or memberships.

- AI Chatbots – Businesses use AI chatbots to handle customer inquiries, process orders, and provide support without human intervention. This frees up time while keeping customers engaged and satisfied.

- Virtual Assistants – If you’re spending too much time on social media management, email responses, or administrative tasks, hiring a virtual assistant (VA) can help. A VA can handle routine work while you focus on business growth.

Why Automation is Essential

Automation allows you to scale your business without increasing workload. Instead of micromanaging every aspect of your business, you create systems that handle operations efficiently and consistently. The more tasks you automate, the more time you have to expand your income streams.

Actionable Tip:

Hire a virtual assistant or use automation tools like Zapier to handle repetitive tasks. This will free up your time and allow you to focus on higher-level strategies that grow your wealth exponentially!

Step 7: Create Passive Income Streams

The final step? Passive income. This is where true financial freedom happens—when your money keeps coming in, even if you stop working. Unlike active income, where you trade time for money, passive income allows you to earn continuously with minimal effort once the system is set up.

Wealthy individuals prioritize passive income because it creates financial security and long-term stability. Instead of working harder, they build assets that generate income automatically.

Best Passive Income Ideas

- Dividend Stocks – Investing in dividend-paying stocks allows you to receive quarterly payments without actively managing investments. Companies like Apple, Coca-Cola, and Microsoft pay shareholders dividends regularly.

- Real Estate Rentals – Owning rental properties provides monthly passive income while the property appreciates in value. Even if you don’t want to manage tenants, investing in Real Estate Investment Trusts (REITs) offers a passive way to benefit from real estate earnings.

- Affiliate Marketing – By promoting products on blogs, YouTube, or social media, you can earn commissions without having to create your own products. Programs like Amazon Associates, ClickBank, and ShareASale allow you to make money by recommending products people already buy.

- Selling Digital Products – Creating eBooks, templates, or online courses allows you to sell the same product repeatedly without additional effort. Unlike physical products, digital products require no inventory and can be sold worldwide. You can create short video ad with the help of Sora by OpenAI to market your product.

Why Passive Income is Key to Financial Freedom

The goal of passive income is to build wealth without constantly working. By diversifying your income streams, you reduce financial stress and create a stable financial future.

Actionable Tip:

Start small—create a simple digital product, set up an affiliate marketing website, or invest in dividend-paying stocks. Over time, your passive income will grow, giving you more financial independence and freedom.

Final Thoughts

Building wealth isn’t about luck—it’s about strategy, discipline, and action. If you follow these seven steps, you’ll be well on your way to financial success.

So, which step will you take first? Watch our YouTube Video on 7 Steps to Build Wealth below and let us know! Don’t forget to Like and feel free to share!